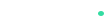

The IRS announced on March 13, 2018 that the 2014 Offshore Voluntary Disclosure Program (OVDP) will close on September 28, 2018. This means that the options available to taxpayers will become more limited and there will be less clarity on possible outcomes for coming into compliance related to unreported foreign assets and income.

The 2014 program is the fourth iteration of the voluntary disclosure programs geared towards bringing taxpayers into compliance with assets located outside the United States. There are other options available for those taxpayers but each taxpayer may have different options available to them depending on their circumstances.

Due to the complicated nature of most of these cases, it can take six months to a year to get all of the information assimilated and complete all of the necessary paperwork to submit an OVDP package which will be an undertaking for most to meet the September 28th deadline.

For taxpayers that qualify to file under one of the other options, there is not a set expiration period at this time, however, the IRS has repeatedly noted their right to close these programs at any time. Integer CPAs has experience working with taxpayers and legal counsel to resolve these compliance issues under each of the possible scenarios. Contact us if you would like to discuss how we can help you.